Banks with a Soul: Reimagining Finance as a Tool for the Common Good

A Workshop Experience at the Economy of Francesco Global Event 2025

Article written by Fabian Storti (Federazione del Nord Est), Maria Cristina Agurto Osorio and Marco Izzia

On November 29, 2025, during the Economy of Francesco Global Event in Castel Gandolfo, Italy, approximately twenty-five participants from across continents gathered for a workshop titled “Banks with a Soul: serving local communities for the Common Good.” The session, part of the Finance and Humanity Village, sought to bridge centuries of cooperative financial tradition with contemporary visions for an economy rooted in dignity, care, and community service.

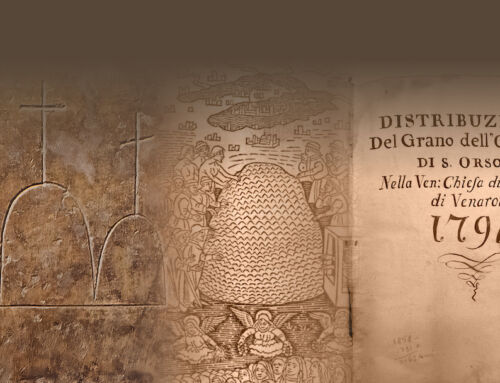

From Monti di Pietà to Cooperative Banking: A Living Tradition

The workshop opened with a journey backward through time, tracing the origins of cooperative finance to the Franciscan movement of the Middle Ages. As cities grew and commerce expanded across Europe, access to credit became essential yet perilously scarce for ordinary people. Families and artisans facing financial emergencies found themselves at the mercy of usurers, whose exploitative interest rates could destroy livelihoods and trap entire communities in spirals of debt. The Franciscans understood a fundamental truth: where fair credit is absent, predatory lending invariably flourishes.

From this recognition emerged the Monti di Pietà, institutions that were neither traditional charity nor conventional banking but something radically new. These early credit cooperatives accepted modest collateral such as tools, clothing, or jewelry, and extended small loans at minimal or no interest. Their guiding principle was revolutionary: capital must circulate to serve the community, not stagnate in private accumulation. The dignity of the borrower mattered. Finance could be structured to empower rather than exploit.

The Monti di Pietà embodied several principles that resonate powerfully today: the circulation of resources for communal benefit, the protection of vulnerable populations from exploitation, reasonable profit that never becomes exploitative, and the understanding that local institutions rooted in their territories can respond most effectively to community needs. These institutions blended credit with solidarity, individual initiative with community responsibility, reminding us that finance is not only about numbers but about people, trust, and community.

Modern cooperative banking, though operating within contemporary regulatory frameworks and digital infrastructures, inherits this same fundamental DNA. The idea that a community can organize itself to provide fair, accessible credit, that finance can serve people rather than the reverse, and that economic development must be linked to the common good: all of this was already present in the Monti di Pietà. Cooperative banks inherited not only the model of mutual support but also the principle that finance is a tool to build stronger, fairer communities. The conviction remains unchanged: finance exists to serve people and territories, not the reverse.

The Values Game: Co-Designing the Bank of the Future

Following this historical foundation, participants were introduced to the contemporary landscape of cooperative credit in Italy, where the Credito Cooperativo system has grown into a significant presence in the national banking market while maintaining its commitment to person-centered finance and territorial service. This bridge between past and present set the stage for the workshop’s central activity: “The Values Game,” a participatory exercise designed to provoke reflection on what values should animate banking institutions capable of serving communities and future generations.

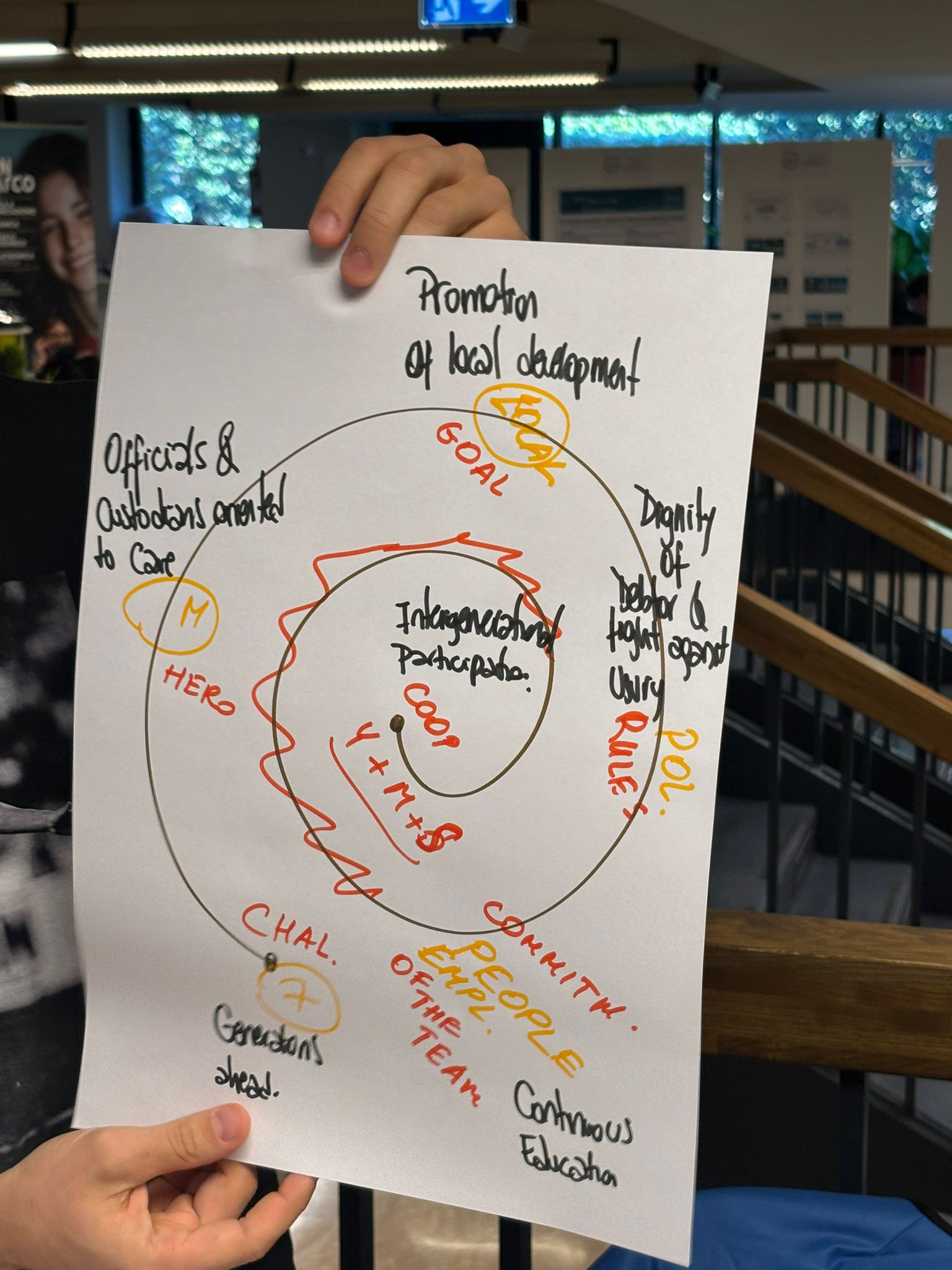

Divided into three diverse groups representing Latin America, North America, Europe, Africa, and beyond, participants received decks of value cards drawn from two complementary traditions: the contemporary Credito Cooperativo movement and the historical Monti di Pietà. Each group was tasked with selecting five core values to define their vision of the bank of the future, imagining financial institutions that could endure and maintain ethical consistency across at least fifty years.

The methodology was deliberately collaborative and dialogue-based. Facilitators circulated among groups as participants discussed, debated, and prioritized, working to articulate not merely abstract ideals but concrete principles that could guide institutional design and daily operations. The diversity within each group proved invaluable, as different cultural contexts and personal experiences enriched the conversations and challenged assumptions.

Emerging Themes: Care, Education, and Local Rootedness

Despite working independently, the three groups converged remarkably on several core themes. Continuous education emerged as essential infrastructure for sustainable cooperative finance, extending beyond client financial literacy to encompass ongoing learning for employees, administrators, and leadership. One group’s conversation was catalyzed by a seventeen-year-old Italian participant who candidly shared his struggle to understand financial decisions. While his peers had gained financial fluency through family guidance, he felt blind in a market his future depended upon. Truly cooperative institutions must empower all members to become confident economic actors rather than passive consumers of opaque financial products.

The dignity of the debtor and the fight against usury appeared repeatedly as foundational commitments. This principle insists that fair credit, transparency, and protection of vulnerable populations must form the ethical backbone of any financial institution. Finance must remain a tool for empowerment, actively resisting exploitative practices and restoring dignity to financial relationships.

Local development and territorial rootedness constituted another powerful convergence. Participants envisioned banks deeply embedded in the communities they serve, attentive to local realities and committed to inclusive, sustainable growth. Rather than extracting value from territories, these institutions would strengthen local ecosystems and contribute to social cohesion, particularly in fragile inland and rural areas.

The Role of People: Custodians and Intergenerational Dialogue

A distinctive feature emerging from the groups was the explicit focus on human agency within institutional structures. Rather than designing from a technical perspective, participants organized their vision around roles and relationships. The heroes of these systems were officials and custodians oriented toward care and client-centeredness: real people whose daily decisions shape institutional culture and impact. As stewards of trust, they ensure fairness, dignity, and respect in every interaction. Human leadership rooted in ethical responsibility is what ultimately safeguards continuity across generations.

Intergenerational participation appeared as a core value in multiple groups. One group placed it at the center of their conceptual framework, represented visually as a spiral. Unlike linear models, the spiral reflects continuous movement, learning, and renewal. Each cycle revisits the same values with deeper understanding, reinforcing care, dignity, and cooperation over time. The experience and wisdom of senior generations enrich new ideas and technologies, while younger generations bring innovation and fresh perspectives. This dialogue between past and future enables institutions to evolve while remaining grounded in enduring principles.

The spiral framework captures something essential about sustainability itself. Lasting institutions are not achieved by reaching a final endpoint but by repeatedly reaffirming shared principles, allowing them to deepen and develop new relevance in changing contexts. The greatest challenge for the bank of the future is not innovation alone but continuity: maintaining ethical consistency as markets evolve, technologies transform, and leadership changes.

Beyond Finance: Integral Ecology and the Common Good

Several groups incorporated values connecting financial practice to broader questions of justice, ecology, and human flourishing. One group used their wildcard to represent integral ecology, responding to the call in Laudato Si’ to recognize our political economy as an interweb connecting human life, nature, and deeper realities. Finance institutions embodying this calling become more than service providers; they become participants in the regeneration of the entire social and ecological fabric.

The theme of justice pervaded many discussions. Participants articulated finance not merely as an economic mechanism but as a powerful tool for social justice and human dignity. One group explicitly sought to demonstrate that financial tools can help bring about systems of justice where the economy grows from fairness and moral strength, and where young people can actively participate in creating their future today.

Reflections and Global Resonance

The workshop proved especially meaningful given the extraordinary diversity present in the room. Participants came from contexts as different as Peru, Mexico, Argentina, the United States, Malta, Italy, and Uganda. While social gaps and economic realities differ dramatically across these nations, the long-term challenge remains remarkably consistent: how can financial systems address inequality and serve human flourishing everywhere? The integral approach and values identified demonstrated relevance across contexts and generations.

The experience offered participants an opportunity to connect ethical reflection with institutional design in ways that felt both intellectually rigorous and practically applicable. Several expressed intentions to continue learning about cooperatives, particularly in impact investing and affordable housing, seeing these organizational structures as genuinely useful for solving contemporary challenges that conventional markets fail to address.

The multicultural composition of groups meant that conversations naturally incorporated multiple perspectives, challenging participants to articulate assumptions and find common ground across difference. This process of shared discernment itself embodied cooperative principles: working together to reach deeper understanding than any individual could achieve alone.

Looking Forward: Finance as Vocation

The workshop succeeded in demonstrating that the historical legacy of the Monti di Pietà and cooperative banking is not merely academic history but a living tradition with urgent contemporary relevance. The values that emerged point toward financial institutions that could genuinely serve the common good: organizations oriented toward care and custodianship, committed to continuous education and intergenerational dialogue, rooted in local territories while connected to broader networks of solidarity, structured to protect dignity and resist exploitation, and guided by an integral vision connecting economic activity to human flourishing and ecological sustainability.

These are not utopian fantasies, but practical possibilities grounded in centuries of experience. Cooperative banks already exist worldwide, managing significant market share while operating according to principles fundamentally different from shareholder-primacy capitalism. The challenge is extending their reach, deepening their commitment to foundational values, and making them accessible to new generations seeking meaningful economic participation.

What became clear through the afternoon’s work was that finance with a soul is not a niche alternative but a necessary foundation for any economy truly serving people and planet. Participants departed with renewed conviction that another kind of finance is possible, and indeed, that it has deep roots reaching back centuries, ready to flourish again in our time.

The gratitude expressed reflected recognition that spaces where serious conversation about economic alternatives can occur across cultures and generations are themselves precious and rare. The Economy of Francesco, in creating such spaces, performs essential work: keeping alive the conviction that economics can be reimagined, that finance can serve justice, and that together, guided by wisdom both ancient and emerging, we can build institutions worthy of the future we hope to inhabit.